Credit card tsumitate is getting better!

Make sure to change your settings for the best cashback rates now.

Credit card tsumitate is a popular system to fill your investment account with a monthly recurring order that goes through your credit card. The main benefit is that you receive a certain cashback rate while doing so. Free money while investing!

Great news is coming to users of this system in 2024. The government has increased the official limit. It used to be 50k, but it has now been increased to 100k. The change is already effective on all major brokers, so go ahead and change your tsumitate settings now!

The yearly 1.2M limit in the tsumitate bucket of your NISA (積立投資枠 - tsumitate toushi waku) needs 100k per month to fill it at the end of the year. You can now fill this bucket every year fully just with your credit card.

Without any change, users would now be able to receive double the amount of money back, since they can double their monthly principal. However, some brokers have adjusted the rates you receive via this system, to accommodate the larger limit. Let’s go over each of the brokers below.

Rakuten’s Gold Card is a no-brainer

Rakuten Securities has not introduced any restrictions or reductions in the points you can receive using credit card tsumitate. This means that you can now simply receive double the points that you used to!

Let’s take a look at the three supported cards from Rakuten, and which one is the best bang for the buck. The basic card can return up to 6000 points per year and has no yearly cost, so it’s a great deal already. But the gold card can do even better! It has a yearly fee of 2200 yen, but makes up for it with 9000 yearly points, giving a final balance of 6800 yen.

The gold card is now a complete no-brainer, which finally convinced me to get one for myself, intending to fill my tsumitate NISA for 2024 with it.

Of course, this is only the case when calculating with a monthly 100k tsumitate. The numbers change if you are only planning to invest smaller amounts. Staying with the basic card makes more sense in that case.

Don’t forget that Rakuten also has a separate tsumitate system using their Rakuten Cash, for an additional 50k per month. Since my tsumitate bucket is already covered with the credit card, I have this one filling my growth bucket instead.

Monex now has a cascading system

Monex has had a strong 1.1% cashback rate until now, but with the limit change, they have introduced a cascading system, as depicted in the table.

The total yearly points you can get with this system is 8760 yen, so actually not bad at all. Their Monex Card has a yearly fee that is easily avoidable if you fulfill their conditions, so it can be considered free.

AU Securities seems very strong

I personally haven’t looked into the AU ecosystem much, but with the 100k limit upgrade, it seems that AU Securities users can now enjoy a full 12000 yen per year in points thanks to a 1% cashback rate using a card where the fee can be waived too.

AU users seem to be getting the best deal out of all the offerings for now. I intend to look into the AU ecosystem soon, since it looks very attractive.

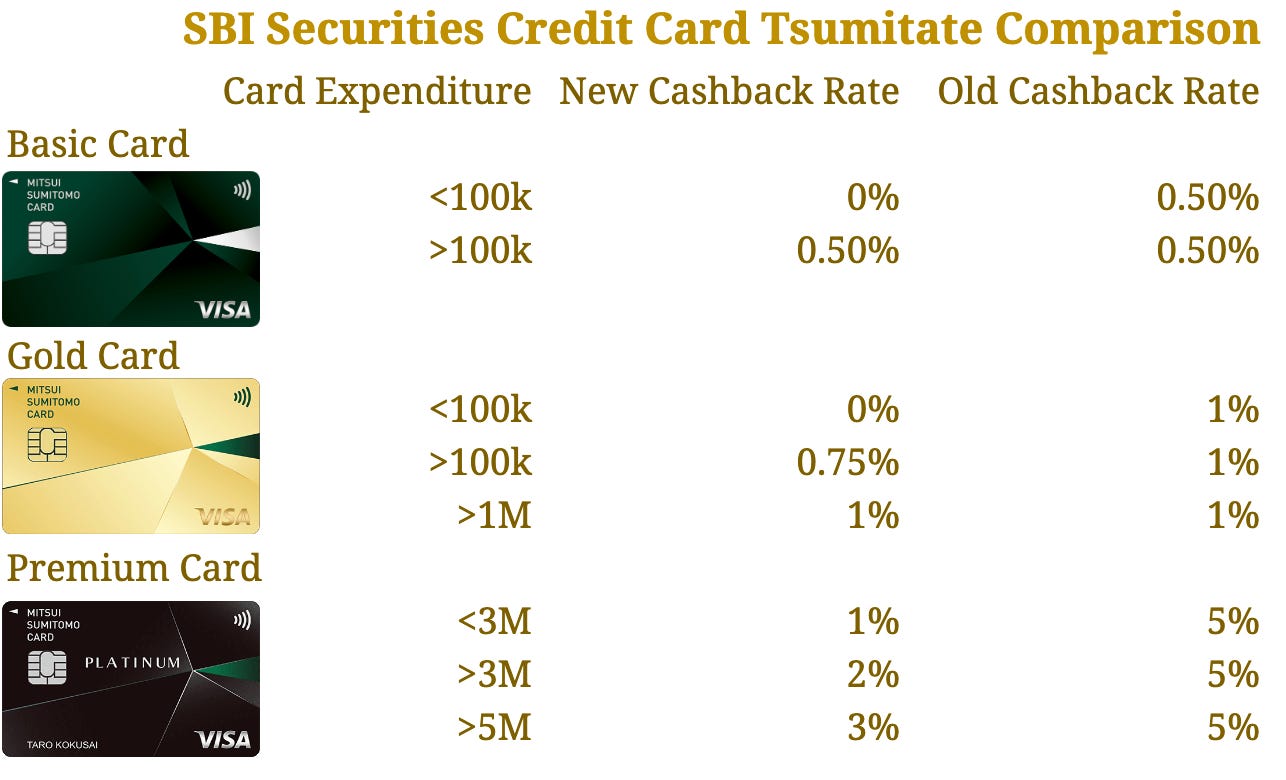

SBI receives quite a downgrade

SBI took a few days more to announce their updated tsumitate rates, and it was probably because they were cooking up this demonic new system based on the yearly expenditure of your card. Tsumitate orders themselves don’t seem to count towards this expenditure either.

The basic card is still fine, since it’s easy to reach 100k expenditure per year. However, if you are a gold card user, you are now required to spend 1M per year to keep the 1% cashback rate you were used to.

Finally, the biggest hit goes to the platinum users. You now have very large expenditure requirements to get the higher rates, and they are no longer as good as the previous 5%. This makes the platinum card much less attractive. The only exception is if you know you already spend more than 5M per year on the card, then the new 3% is actually more total points than the previous 5%, since the principal is doubled.

The sweet spot, to me, seems to be in the gold card with 0.75% rate. Since the card can be made free if you pass some conditions, you can get a clean 9000 yen per year with this. This is slightly better than the Rakuten gold card, since the latter doesn’t have a waivable fee.

These SBI changes go into effect from October of 2024, so you still have time to enjoy SBI’s current rates. Also, recently created cards are exempt from this change for their first year too. Platinum owners, make sure to squeeze out as much as you can from that 5%!

What is your tsumitate plan for 2024?

Let me know in the comments what your plan of action will be!

So nice, I didn't know about it! I've just updated my tsumitate.

The bad thing is tsumitate set today will execute in May 😥